Rental Property Maintenance: Pain-in-the-Neck or Opportunity for Greater Value and Resident Satisfaction?

January 2025

For many real estate investors and rental property owners, maintenance can seem like a necessary evil—a constant expense and hassle that detracts from the overall profitability of their investment. However, when approached proactively, maintenance can become a powerful tool to enhance property value, boost resident satisfaction, and ultimately drive business success. In this article, we will explore how preventive and corrective maintenance strategies can transform your rental property into a competitive advantage.

Preventive Maintenance: The Proactive Approach

Preventive maintenance is about anticipating and addressing potential issues before they become major problems. This proactive approach not only saves money by reducing costly repairs but also preserves the property's value and appeal. Here are some key preventive maintenance practices to implement:

- Regular Inspections: Conduct seasonal inspections to identify minor issues early. This includes checking HVAC systems, plumbing, roofs, and exterior conditions.

- HVAC and Plumbing Checks: Regularly service HVAC systems and inspect plumbing to prevent leaks and ensure efficient operation.

- Gutter Cleaning and Yard Maintenance: Clean gutters annually and maintain yard conditions to prevent water damage and pest infestations.

- Energy Efficiency: Improve energy efficiency by servicing HVAC systems, sealing drafts, and insulating pipes, which can lead to lower utility costs and a more sustainable property.

Corrective Maintenance: Addressing Issues Promptly

Corrective maintenance involves fixing problems as they arise. While it is reactive rather than proactive, it is equally important for maintaining tenant satisfaction and property integrity. Here are some strategies for effective corrective maintenance:

- Prompt Response: Respond quickly to maintenance requests to prevent minor issues from escalating into major repairs.

- Clear Communication: Keep tenants informed about ongoing repairs and timelines to build trust and reduce frustration.

- Professional Contractors: Establish relationships with reliable contractors to ensure high-quality repairs and minimize downtime.

Benefits of Effective Maintenance

Implementing both preventive and corrective maintenance strategies offers numerous benefits:

Increased Property Value

Well-maintained properties retain their value and can even increase in value over time, making them more attractive to potential buyers when it's time to sell.

Tenant Satisfaction and Retention

Residents are more likely to renew leases when living in a well-maintained property, reducing turnover costs and ensuring consistent rental income.

Cost Savings

Preventing costly repairs through early intervention saves money in the long run and reduces unexpected expenses.

Legal Compliance

Regular maintenance ensures compliance with safety and health regulations, reducing liability risks and potential fines.

The Bottom Line

Maintenance is not just a chore; it is a strategic investment in your rental property's future. By adopting proactive preventive maintenance and responsive corrective maintenance practices, you can transform your property into a competitive advantage. This not only enhances property value and resident satisfaction but also fosters long-term financial success. It's key to understand the importance of maintenance in delivering a superior rental experience and maximizing investment returns. By prioritizing maintenance, you can ensure that your rental property remains a valuable asset for years to come.

To maximize your real estate investment returns, partner with Jkom for expert guidance on strategic market analysis, proactive property management, and value growth strategies. Our team ensures you achieve passive income and value growth while delivering a modern, resident-friendly experience. Contact us today to elevate your investment portfolio.

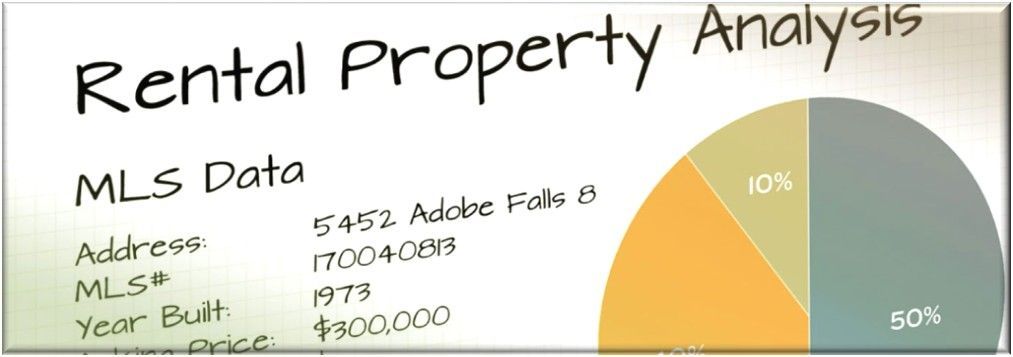

Are you ready to turn your rental property into a cash machine? But do you know what makes a property truly profitable? Let’s explore four key factors every real estate investor should analyze before investing in a rental property in Atlanta. Cash Flow Analysis The cornerstone of evaluating any rental property is conducting a thorough cash flow analysis. This process helps determine whether the property will generate profit or lead to losses. The formula is straightforward: Rental Income − Total Expenses = Net Cash Flow Start by estimating potential rental income based on market rates for comparable properties in the area. Then, calculate all expenses, including mortgage payments, property taxes, insurance, maintenance costs, property management fees, and HOA dues (if applicable). Don’t forget to factor in vacancy rates and unexpected repairs. A property with positive cash flow generates more income than it costs to operate, making it a sound investment. Negative cash flow, on the other hand, signals potential financial strain. Market Trends Understanding local market trends is crucial for making informed investment decisions. In Atlanta, factors such as population growth, economic conditions, and shifts toward suburban living play a significant role in shaping rental demand and property values. For instance: Atlanta’s population is booming, particularly among young professionals and families. The city is a hub for Fortune 500 companies and start-ups, ensuring steady job growth. Suburban areas are gaining traction due to affordability and lifestyle preferences. These trends suggest that Atlanta’s rental market will continue to experience modest growth in demand and property values in 2025. Staying informed about these dynamics helps investors optimize rental pricing, reduce vacancy periods, and identify emerging opportunities. Property Condition A detailed assessment of the property’s condition is essential to avoid costly surprises down the line. Begin with an exterior inspection—evaluate the roof, foundation, siding, and landscaping for signs of wear or damage. Inside the home, check structural integrity as well as plumbing, electrical systems, HVAC units, and interior finishes. For any necessary repairs or upgrades, obtain quotes from contractors and add a contingency budget of 10-20% for unexpected expenses. Address safety or compliance issues first before considering aesthetic improvements. A well-maintained property not only attracts quality tenants but also minimizes long-term maintenance costs. Neighborhood Analysis The neighborhood’s quality can significantly impact tenant demand and long-term profitability. Conduct a visual assessment of the area—look for well-maintained homes, clean streets, and accessible amenities like parks and schools. Research crime statistics and evaluate proximity to employment centers and public transportation. Additionally, investigate the neighborhood’s growth potential by reviewing planned developments or infrastructure projects. A desirable location with strong growth prospects will ensure consistent tenant interest and higher rental income over time. The Bottom Line From cash flow analysis to market trends, property condition assessments to neighborhood evaluations—these four factors are essential for determining whether a rental property is worth your investment. By mastering these steps, you’ll make confident decisions that lead to profitable outcomes. To maximize your real estate investment returns, partner with Jkom for expert guidance on strategic market analysis, proactive property management, and value growth strategies. Our team ensures you achieve passive income and value growth while delivering a modern, resident-friendly experience. Contact us today to elevate your investment portfolio. .

Real estate appreciation is one of the most compelling reasons investors are drawn to real estate as an asset class. Simply put, appreciation refers to the increase in a property’s value over time. While it’s not guaranteed, understanding how appreciation works—and the factors that influence it—can help you make smarter investment decisions and maximize your returns. Whether you’re a seasoned investor or a rental property owner looking to grow your portfolio, this guide will provide you with everything you need to know about real estate appreciation. Types of Real Estate Appreciation There are two primary types of real estate appreciation: natural appreciation and forced appreciation. Both can significantly impact your property’s value, but they occur under different circumstances. Natural Appreciation Natural appreciation occurs when market forces drive up property values over time. This type of appreciation is influenced by external factors such as supply and demand, economic growth, and inflation. For example: If a city experiences population growth and an influx of businesses, the increased demand for housing can push property values higher. Inflation also plays a role, as rising prices across the economy often lead to higher real estate values. Natural appreciation is largely out of your control as an investor, but understanding market trends can help you identify areas with strong potential for growth. Forced Appreciation Forced appreciation happens when you actively increase a property’s value through improvements or better management. This is common in rental properties and fix-and-flip investments. Examples include: Renovating kitchens or bathrooms to modernize the property. Adding amenities like energy-efficient appliances or smart home features. Increasing rental income through better tenant management or repositioning the property in the market. Forced appreciation gives investors more control over their ROI, making it a powerful strategy for increasing property value. Factors Influencing Real Estate Appreciation Here are six powerful factors that contribute to real estate appreciation. Understanding these can help you identify high-potential markets and properties. 1. Location The old adage “location, location, location” holds true for real estate appreciation. Properties in desirable areas—such as those with good schools, low crime rates, and access to amenities—tend to appreciate faster. Proximity to job centers, public transportation, and recreational facilities can also boost demand and drive up values. 2. Economic Growth A thriving local economy often leads to job creation and population growth, which increases demand for housing. Cities experiencing economic expansion typically see higher rates of natural appreciation. 3. Supply and Demand When housing supply is limited but demand remains high, property values tend to rise. Markets with strict zoning laws or geographic constraints (like coastal cities) often experience faster appreciation due to limited inventory. 4. Inflation As the cost of goods and services increases over time, so does the cost of real estate. Inflation-driven appreciation is a natural hedge against currency devaluation. 5. Property Improvements As mentioned earlier, strategic renovations and upgrades can significantly increase a property’s value through forced appreciation. 6. Market Trends Emerging trends—such as remote work driving suburban migration or increased demand for multi-family housing—can create opportunities for rapid appreciation in certain markets. How to Maximize Real Estate Appreciation To make the most of real estate appreciation, consider these tips: Do Your Research: Analyze market trends, economic indicators, and population growth data before investing. Focus on Value-Add Opportunities : Look for properties where you can create forced appreciation through renovations or operational improvements. Think Long Term: Real estate typically appreciates over time, so patience is key. Diversify Your Portfolio: Spread your investments across different markets to reduce risk and capitalize on various growth opportunities. The Bottom Line Real estate appreciation is a powerful wealth-building tool that can significantly enhance your return on investment. By understanding the types of appreciation and the factors that influence it, you can make informed decisions that align with your financial goals. Whether you’re relying on natural market forces or leveraging forced appreciation through strategic improvements, staying proactive and informed will set you up for long-term success in real estate investing. To maximize your real estate investment returns, partner with Jkom for expert guidance on strategic market analysis, proactive property management, and value growth strategies. Our team ensures you achieve passive income and value growth while delivering a modern, resident-friendly experience. Contact us today to elevate your investment portfolio.

The Atlanta real estate market is undergoing significant changes, presenting a unique set of opportunities for investors and rental property owners. As properties remain on the market for longer periods, prices are adjusting downward, and capitalization rates are improving. This shift creates an environment where acquiring profitable rental properties and investment assets becomes increasingly attractive. For those considering expanding their portfolios, now may be the ideal time to take action. Longer Listings: Greater Negotiation Power One of the clearest indicators of a market favoring investors is the rise in days on market (DOM). An increasing DOM suggests that demand is softening, placing sellers in a more flexible position. This flexibility translates into greater negotiation power for buyers. Sellers are more likely to accept lower offers, cover closing costs, or agree to more favorable terms to secure a deal. Whether you're interested in single-family rentals, multifamily properties, or commercial assets, longer listing times increase the likelihood of acquiring properties at more competitive prices. Lower Prices: Affordable Entry Points Falling house prices offer investors discounted properties, higher returns, and more affordable financing options. Properties that were previously out of reach become more accessible, reducing the upfront investment required. This creates the potential for higher returns when prices eventually recover. Lower purchase prices can often translate to better rental yields for buy-to-let properties, as demand for rental homes remains strong due to affordability challenges that keep many people renting. Improved Capitalization Rates As prices decrease and rental income remains stable, capitalization rates improve. This means that investors can achieve higher returns on their investments compared to previous market conditions. Improved capitalization rates are particularly beneficial for rental property owners, as they indicate a better return on investment (ROI) for each property. This shift makes it an excellent time for investors to reassess their portfolios and consider adding new assets at favorable valuations. Future Capital Growth Potential Historically, the property market has demonstrated resilience and long-term growth. While short-term dips may occur, the overall trajectory tends to trend upwards. Investors who buy during a downturn could benefit significantly from capital appreciation when the market rebounds. This long-term perspective is crucial for real estate investors, as it allows them to ride out market fluctuations and capitalize on future growth. Access to More Financing Options As house prices drop, lenders may introduce competitive mortgage products to attract buyers. Lower borrowing costs, combined with reduced property prices, make it an opportune moment for investors to secure affordable financing. Additionally, bridging loans are becoming more accessible, providing fast access to funds and allowing investors to move quickly on discounted properties before prices rebound or competition increases. Strategic Investment Opportunities In a shifting market, investors have the opportunity to diversify their portfolios by acquiring properties at discounted prices. This not only spreads risk but also positions investors for potential long-term gains. By leveraging market conditions, investors can secure high-quality assets that deliver strong, consistent income streams. Furthermore, the ability to negotiate favorable terms and secure properties at lower prices enhances the potential for passive income and long-term wealth creation. The Bottom Line The current real estate market presents a compelling opportunity for investors and rental property owners. With longer listings and lower prices, the conditions are ripe for strategic acquisitions that can yield higher returns and long-term growth. By understanding these market dynamics and acting decisively, investors can capitalize on the shifting landscape to build a robust and profitable real estate portfolio. Whether you're looking to expand your existing holdings or enter the market for the first time, now is an ideal moment to explore the benefits that this changing market offers. To maximize your real estate investment returns, partner with Jkom for expert guidance on strategic market analysis, proactive property management, and value growth strategies. Our team ensures you achieve passive income and value growth while delivering a modern, resident-friendly experience. Contact us today to elevate your investment portfolio.

Owning rental properties can be a lucrative investment strategy, offering a steady income stream and potential for long-term wealth growth. However, managing these properties effectively requires significant time, expertise, and resources. As your portfolio expands, the challenges of managing multiple properties can become overwhelming, leading many investors to consider hiring a property management company. Here are some key indicators that suggest it might be time to bring in professional help: Growing Portfolio Complexity As you acquire more rental properties, the complexity of management increases exponentially. Each property requires attention to maintenance, tenant relations, financial management, and legal compliance. If you find yourself struggling to keep up with these demands across multiple properties, it may be time to seek professional assistance. Property management companies are equipped to handle these tasks efficiently, allowing you to focus on strategic investment decisions rather than day-to-day operations. Time Constraints Managing rental properties is a 24/7 job, requiring immediate attention to issues like maintenance emergencies or late rent payments. If your evenings and weekends are consistently consumed by property-related tasks, it's likely impacting other areas of your life. A property manager can alleviate this burden, ensuring that your properties are well-maintained and your personal time is preserved. Difficulty Finding or Retaining Tenants High vacancy rates or frequent tenant turnover can significantly impact your cash flow and overall profitability. Property managers have extensive networks and marketing strategies to attract qualified tenants, reducing vacancy periods and improving tenant retention through effective communication and resident relations. Consistent Maintenance Issues If you're frequently dealing with maintenance requests or repairs, it can be both time-consuming and costly. Property managers have established relationships with reliable contractors and can handle these issues promptly, ensuring your properties remain in good condition and minimizing downtime. Legal and Compliance Challenges Navigating legal complexities, such as eviction processes or compliance with local regulations, can be daunting for individual landlords. Property management companies are well-versed in these areas, providing peace of mind and protecting your investment from potential legal liabilities. Geographical Distance If your rental properties are located far from your residence, managing them effectively can be challenging. Local property managers can respond quickly to emergencies, conduct regular inspections, and maintain strong relationships with tenants, ensuring your properties are well-managed even when you're not nearby. Inconsistent Rent Collection Inconsistent or late rent payments can disrupt your cash flow and financial stability. Property managers implement efficient rent collection systems, including automated reminders and flexible payment options, to ensure timely payments and minimize delinquencies. The Bottom Line While hiring a property management company may initially seem like an added expense, the benefits often outweigh the costs. By outsourcing the day-to-day management of your rental properties, you can focus on growing your portfolio, improving your work-life balance, and maximizing your investment returns. If you identify with any of the indicators mentioned above, it may be time to consider partnering with a professional property management company to optimize your rental property investments. To maximize your real estate investment returns, partner with Jkom for expert guidance on strategic market analysis, proactive property management, and value growth strategies. Our team ensures you achieve passive income and value growth while delivering a modern, resident-friendly experience. Contact us today to elevate your investment portfolio.

As a real estate investor or rental property owner, understanding and implementing effective tax strategies can significantly impact your bottom line. By leveraging these strategies, you can maximize your profits and minimize your tax burden. Here are some key tax strategies to consider for real estate investment success: Maximize Expense Write-offs One of the most powerful tax strategies for real estate investors is to maximize expense write-offs. You can deduct a wide range of expenses related to your investment properties, including: Property taxes and insurance Maintenance and repair costs Property management fees Advertising expenses for finding tenants Legal and accounting fees Business-related tools and resources (e.g., software, computers) By meticulously tracking and deducting these expenses, you can significantly reduce your taxable income. Deduct for Depreciation Depreciation is a non-cash expense that allows you to deduct the cost of your property over its useful life. The IRS considers the useful life of residential rental properties to be 27.5 years. This deduction can substantially reduce your taxable income, even if your property is actually appreciating in value. Take Advantage of Deductions Beyond regular expenses, there are several other deductions available to real estate investors: Mortgage interest deduction Travel expenses related to managing your properties Home office deduction if you use part of your home exclusively for your real estate business These deductions can add up to significant tax savings over time. Leverage Tax Incentives The government offers various tax incentives to encourage real estate investment: 1031 Exchange: This allows you to defer capital gains taxes by reinvesting the proceeds from a property sale into a similar property within 180 days. Opportunity Zone Investments: By investing in designated economically distressed areas, you can defer or even eliminate capital gains taxes. Borrowing Against Your Equity Instead of selling a property and incurring capital gains taxes, consider borrowing against your equity. This strategy allows you to access funds without triggering a taxable event. Hold Properties for More Than 1 Year By holding properties for more than a year before selling, you can benefit from lower long-term capital gains tax rates. These rates are typically 0%, 15%, or 20%, depending on your income level, which is significantly lower than short-term capital gains rates. Live in the Property for 2 Years The "2-out-of-5-years rule" allows you to exclude up to $250,000 ($500,000 for married couples) of capital gains from the sale of your primary residence. By living in your investment property for at least two out of the five years before selling, you can take advantage of this substantial tax break. Own Properties in a Self-Directed IRA Investing in real estate through a Self-Directed IRA can offer significant tax advantages. With a Traditional IRA, your investments grow tax-deferred, while a Roth IRA allows for tax-free growth. This strategy can lead to substantial tax savings over time, especially if your properties appreciate significantly. Pass-Through Tax Deduction Many real estate investors can deduct up to 20% of their qualified business income, reducing their overall tax liability. Cost Segregation This strategy allows you to accelerate depreciation on certain components of your property, potentially leading to larger tax deductions in the early years of ownership. Energy-Efficient Improvements Making energy-efficient upgrades to your properties can qualify you for tax credits and deductions. By implementing these tax strategies, real estate investors can significantly reduce their tax burden and increase their overall returns. However, tax laws are complex and constantly changing, so it's crucial to consult with a qualified tax professional or CPA who specializes in real estate investing. They can help you navigate the intricacies of these strategies and ensure you're maximizing your tax benefits while remaining compliant with IRS regulations. The Bottom Line Remember, effective tax planning is an ongoing process. Regularly review and adjust your strategies as your real estate portfolio grows and tax laws evolve. By staying informed and proactive, you can optimize your tax position and achieve greater success in your real estate investments. To maximize your real estate investment returns, partner with Jkom for expert guidance on strategic market analysis, proactive property management, and value growth strategies. Our team ensures you achieve passive income and value growth while delivering a modern, resident-friendly experience. Contact us today to elevate your investment portfolio.

As a real estate investor or property owner, expanding your portfolio can be an exhilarating journey towards greater wealth and financial freedom. However, scaling requires careful planning and execution. Here are five essential tips to help you grow your real estate portfolio strategically and sustainably. 1. Leverage Financing Options Wisely One of the most effective ways to scale your real estate portfolio is by leveraging financing options. Instead of using all your capital to purchase properties outright, consider utilizing mortgages and loans to acquire more assets. This approach allows you to control more properties with less initial investment, potentially accelerating your portfolio's growth. However, it's crucial to be cautious about overleveraging. Rapid expansion often requires assuming additional debt, which can lead to financial strain if not managed properly. Always ensure that your properties generate sufficient cash flow to cover debt obligations and other expenses. 2. Diversify Your Investments Diversification is key to minimizing risk and maximizing returns in real estate investing. Consider investing in different property types, such as residential, commercial, and industrial properties. Additionally, explore various geographical locations to spread out your risk and tap into different market opportunities. Diversification can also mean exploring different investment strategies. For instance, you might combine long-term rentals with short-term rentals or fix-and-flip projects. This approach can help you capitalize on various market conditions and create multiple income streams. 3. Build a Strong Team As your portfolio grows, so does the complexity of managing it. Building a reliable team of professionals is crucial for efficient scaling. This team might include: Real estate agents Property managers Contractors Financial advisors Legal experts Having the right people in place allows you to delegate critical responsibilities, freeing you to focus on strategic growth and decision-making. When hiring, look beyond technical expertise and seek individuals who align with your values and can adapt to the dynamic nature of real estate investing. 4. Implement a Robust Tech Stack In today's digital age, leveraging technology is essential for scaling your real estate portfolio efficiently. A well-implemented tech stack can streamline operations, reduce costs, and improve tenant satisfaction. Consider adopting: A comprehensive property management system to centralize tenant communications, rent collection, and maintenance requests Virtual leasing and showing tools to streamline the leasing process AI-driven tools for tenant screening and management Financial software for accurate tracking and reporting These technological solutions can significantly enhance your ability to manage a larger portfolio without proportionally increasing your workload. 5. Reinvest Strategically Reinvesting your profits is crucial for exponential growth in real estate. Use the income generated from your properties to acquire additional assets or improve existing ones. This compounding effect can significantly increase your portfolio over time. However, reinvestment should be strategic. Create a reinvestment plan that outlines how much of your profits will be reinvested and in what types of properties. Consider market trends, potential for appreciation, and how new acquisitions fit into your overall portfolio strategy. The Bottom Line Scaling your real estate portfolio requires a combination of strategic planning, continuous learning, and effective execution. By leveraging financing wisely, diversifying your investments, building a strong team, implementing technology, and reinvesting strategically, you can create a robust and growing real estate portfolio. Remember, successful scaling is not just about acquiring more properties, but about creating a sustainable foundation for long-term growth and wealth building in the dynamic world of real estate investing. To maximize your real estate investment returns, partner with Jkom for expert guidance on strategic market analysis, proactive property management, and value growth strategies. Our team ensures you achieve passive income and value growth while delivering a modern, resident-friendly experience. Contact us today to elevate your investment portfolio.